Become part of the BENY Club and enjoy the care you truly deserve.

Fill out the registration form, receive a 5% discount on your first purchase, and start enjoying all the benefits today.

Become part of the BENY Club and enjoy the care you truly deserve.

Fill out the registration form, receive a 5% discount on your first purchase, and start enjoying all the benefits today.

Details

Date 31. 8. 2022

Category Investments

Share

Beauty has a value that lasts for ages. Diamonds are proof of that. Particularly in uncertain times, these precious minerals can be a unique asset with which difficult times can be overcome with as little harm as possible. BENY offers the opportunity to invest in diamonds that will value your investment for a long time.

Investing in diamonds presents an exciting opportunity for portfolio diversification. Unlike stock markets or cryptocurrencies, which can be highly volatile, diamonds maintain their value over the long term and even show steady price growth over decades. This is not a random trend - it is the result of several key factors that make investment diamonds a truly exceptional commodity.

It's good to note from the outset that while diamond investments are among the less risky, they are also more conservative. Nevertheless, it offers valuable advantages: diamonds are durable, easy to carry and store, and you can also have them incorporated into your jewellery.

Other benefits include:

A diamond isn't just a beautiful gemstone - it's a complex combination of several key characteristics that together determine its value and investment potential. It is essential for an investor to understand these characteristics in order to make informed decisions.

When you talk about a diamond, you often hear how many carats it has. It's not a misspelling of the flower's name, nor the number of facets cut, nor the amount of sparkle, but the weight of the magnificent mineral. This allows us to calculate how much our chosen diamond weighs, as 1 carat (ct) = 0.2 g. The more carats, the higher the value.

Interestingly, the price of a diamond does not grow linearly with its weight. A diamond weighing 2 carats is not 2 times, but often 3 to 4 times more expensive than a 1 carat diamond of the same quality. This is because larger diamonds are rarer in nature - the probability of finding a large diamond is exponentially lower than finding a small one.

It is important for investors to know that there are so-called 'magic limits' to carat weight. Diamonds weighing just below these boundaries (e.g. 0.95 ct instead of 1.00 ct) may represent a better investment opportunity because their price is noticeably lower, while visually they are virtually indistinguishable from those that have surpassed the magic threshold.

Investment diamonds are also a breathtaking testament to the art of the cutter, who can conjure extraordinarily beautiful pieces from the rough. A standard brilliant cut diamond usually has 57 facets.

But you would hardly be able to count them by eye in a display case. The preserved size of the diamond and, naturally, its shape tell you more about the cutter's skill . The most common shape is round. Alongside the oval, pear and heart, the cushion-cut is easy to spot. Other interesting shapes are the princess or the emerald.

Having chosen the most impressively shaped diamond of a certain weight, you should also be interested in whether the diamond in question has a certificate issued to it. There are several companies that deal with diamond grading. Along with the Antwerp-based Hoge Raad voor Diamant (HRD ) and the International Gemological Institute (IGI) from the same city, the world's most respected diamond grading society is the GIA, or Gemological Institute of America.

For a truly valuable investment in diamonds, a certificate from a reputable gemological laboratory is absolutely essential. Without it, a diamond is virtually unsaleable on the secondary market and its investment potential is severely limited. The certificate serves as the diamond's birth certificate and confirms its authenticity and quality parameters.

Each certified diamond receives a unique identification number, which is often microscopically engraved on its setting. This number makes it possible to always uniquely identify a particular stone and link it to its certificate, which is key to preserving its value for future sales.

The GIA is a non-profit organization that assesses the value of gems, pearls and jewelry in addition to diamonds. The history of the GIA dates back to 1920. But what it's more famous for is its groundbreaking and still most respected diamond grading system - the 4Cs. Or Cut, Carat (weight), Color and Clarity.

This system has created a completely transparent environment in the diamond industry, where every investor knows exactly what they are paying for. Prior to the 4C system, diamond grading was highly subjective and inconsistent, making it difficult to value and trade diamonds.

It is essential for investors to understand that all four Cs have a synergistic effect on the value of a diamond. A diamond that is excellent in one category but below average in the others will not have the same investment value as a stone with balanced performance in all categories.

The colour of a diamond is a specific characteristic that experts attribute surprising labels to for the layman. White diamonds have their colour marked with the letters D to Z. D indicates that the diamond has the best color, or contains the least amount of yellow saturation. On the other hand, the Z indicates that the yellowing is the highest. Colored diamonds are classically recognized by their color. Pink, green and blue ones are increasingly valuable, especially if their colour is more saturated.

For investors, it is important to know that although category D (completely colorless) diamonds are the most valuable on the basic scale, they may not always represent the best investment opportunity. E and F category diamonds are virtually indistinguishable to the human eye from D category diamonds, but their price can be 15-20% lower.

In contrast, so-called colored diamonds represent an entirely different investment category. In particular, pink, blue and green diamonds have seen a dramatic rise in value over the past few decades. For example, some pink diamonds have increased in value by more than 300% over the last 20 years, far outpacing even the finest colourless diamonds.

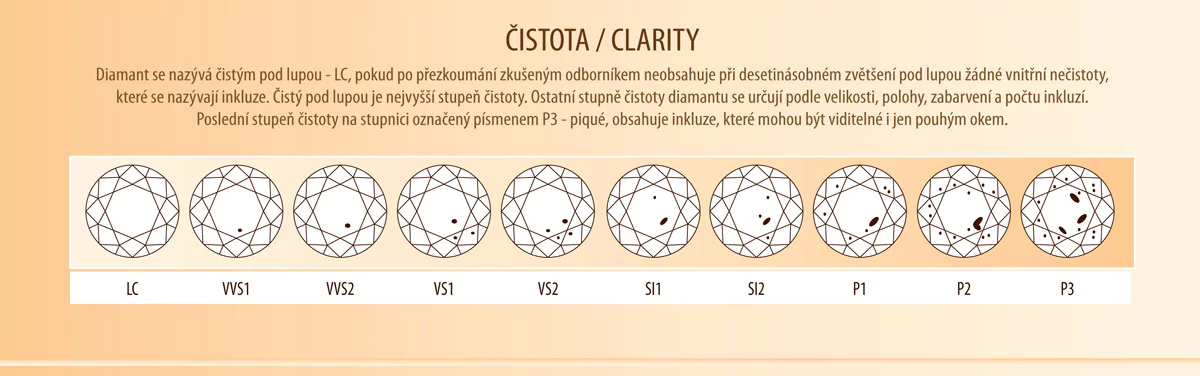

Of the 4 important indicators of a diamond's value, its clarity is also important. It can be examined at a reference magnification of 10x with a magnifying glass. A perfect optic will not miss any impurity in the diamond, which can be a cloudy or spotty diamond, as well as mechanical defects in the form of cracks, fissures, dimples, etc. Therefore, it is important to take good care of the diamond and to see that it is not damaged even slightly.

The clarity of a diamond is rated on a scale from FL (Flawless - perfect clarity) to I3 (Included - significant inclusions). Investment diamonds usually range from FL to VS2 (Very Slightly Included).

It is important for investors to know that some imperfections are only visible under a microscope and have no effect on the appearance of the diamond under normal observation. Therefore, VS1 or VS2 diamondsoften represent better value for money than absolutely pure FL diamonds, which are significantly more expensive.

When considering an investment in diamonds, investors are often faced with the dilemma of whether to invest in rough investment diamonds or diamond jewellery. Both options have their merits and specifics to consider.

Investment diamonds are therefore an ideal choice for investors who are looking for a purely rational alternative to traditional financial assets and want to maximise the return on their investment.

Diamond jewellery is therefore a suitable choice for those who want to combine investment with the joy of owning a beautiful object, or are looking for a valuable gift with investment potential.

At BENY we offer both investment diamonds and diamond jewellery, please do not hesitate to contact us.

Other articles

Notice